The Funding Puzzle: Piecing Together Your Startup Dreams

Embarking on the journey of turning your startup dreams into reality is an exhilarating experience. However, one of the biggest challenges that aspiring entrepreneurs face is securing the funding needed to launch and grow their business. The funding puzzle can often seem complex and overwhelming, but with the right strategies and mindset, you can piece it together successfully.

The first step in piecing together the funding puzzle for your startup is to clearly define your business idea and goals. What problem are you solving? Who is your target market? What makes your product or service unique? Having a clear and compelling business plan will not only attract potential investors but also give you a roadmap to follow as you build your startup.

Once you have a solid business plan in place, the next piece of the puzzle is to identify the right funding sources for your startup. There are various options available, including bootstrapping, crowdfunding, angel investors, venture capitalists, and small business loans. Each funding source has its own pros and cons, so it’s important to research and choose the ones that align with your business goals and values.

Bootstrapping, or self-funding, is a popular option for many startups, as it allows you to retain full control over your business without taking on debt or giving up equity. While bootstrapping may require you to invest your own savings or work another job to support your startup, it can be a sustainable and rewarding way to grow your business organically.

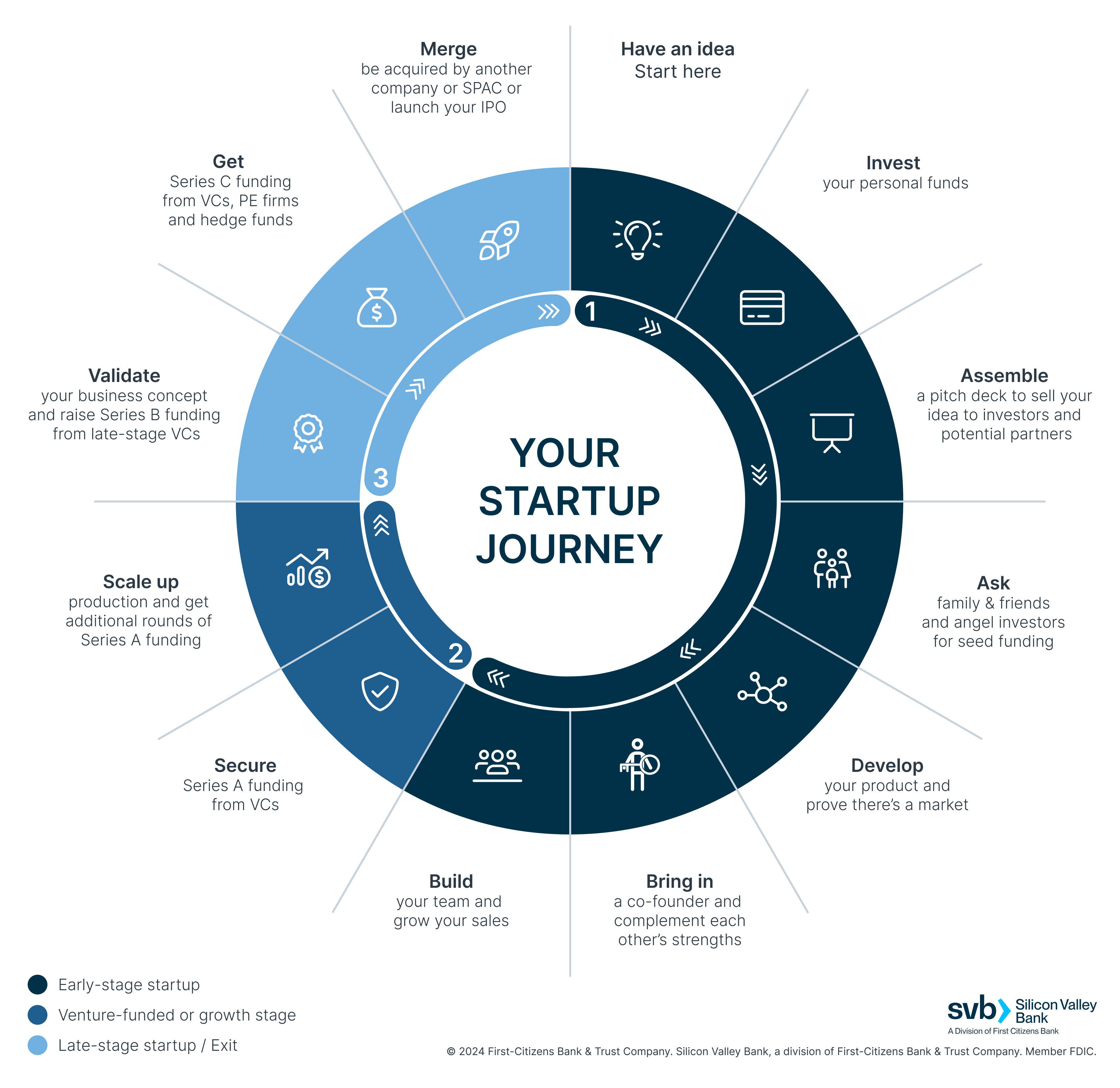

Image Source: svb.com

Crowdfunding is another popular funding option for startups, as it allows you to raise capital from a large number of individuals who believe in your idea. Platforms like Kickstarter and Indiegogo have helped countless startups raise the funds needed to bring their products to market. Crowdfunding not only provides financial support but also helps you build a community of loyal customers and supporters.

Angel investors and venture capitalists are another funding option for startups looking to scale quickly. These investors provide capital in exchange for equity in your business, and often bring valuable expertise and connections to the table. While working with angel investors and venture capitalists can help you accelerate your growth, it’s important to carefully vet potential investors to ensure they align with your long-term vision for your startup.

Small business loans are a more traditional funding option for startups that have a solid business plan and a track record of revenue. Banks and credit unions offer a variety of loan options, including term loans, lines of credit, and SBA loans, to help you finance your startup’s growth. While taking on debt can be a risky proposition, it can also provide the capital you need to expand your business and reach new customers.

In addition to traditional funding sources, there are also a number of grants and competitions available to help startups secure the funding they need. Many government agencies, foundations, and organizations offer grants to support innovative startups in various industries. Participating in pitch competitions and accelerator programs can also provide funding, mentorship, and networking opportunities to help you grow your business.

As you piece together the funding puzzle for your startup, it’s important to stay flexible and open-minded. Building a successful business often requires a combination of funding sources and creative strategies. By staying focused on your goals and persevering through the inevitable challenges, you can secure the funding needed to turn your startup dreams into reality.

Money Matters: How to Secure Funding for Your Big Idea

So, you have a big idea for a startup. You’ve done your research, crafted a solid business plan, and assembled a talented team. Now, all that’s left is securing the funding to turn your dreams into reality. But where do you start? How do you navigate the world of investors, loans, and grants to find the right fit for your startup?

Securing funding for your big idea can seem like a daunting task, but with the right approach and a little bit of know-how, you can make it happen. Here are some tips to help you navigate the world of money matters and secure the funding you need to bring your startup to life.

1. Do Your Homework

Before you start reaching out to potential investors or applying for loans, it’s important to do your homework. Research different funding options available to startups, including angel investors, venture capitalists, crowdfunding, and government grants. Each option has its own set of pros and cons, so make sure you understand the risks and benefits of each before making a decision.

2. Craft a Compelling Pitch

Once you’ve done your research and identified potential funding sources, it’s time to craft a compelling pitch. Your pitch should clearly outline your big idea, the problem it solves, and why it’s a worthwhile investment. Make sure to tailor your pitch to the specific needs and interests of the investor or organization you’re pitching to, and be prepared to answer any questions they may have about your startup.

3. Build Relationships

Securing funding for your startup is not just about selling your big idea – it’s also about building relationships. Take the time to network with potential investors, attend industry events, and connect with other entrepreneurs in your field. Building strong relationships with investors and other key players in the startup world can help you secure funding and open doors to new opportunities for your business.

4. Be Transparent

When seeking funding for your startup, it’s important to be transparent about your financials, business plan, and any potential risks. Investors want to know that you have a solid plan in place and that you’re aware of the challenges ahead. By being honest and upfront about your startup’s strengths and weaknesses, you can build trust with potential investors and increase your chances of securing funding.

5. Explore Alternative Funding Options

Securing funding for your big idea doesn’t always have to come from traditional sources like angel investors or venture capitalists. There are a variety of alternative funding options available to startups, including crowdfunding platforms, business incubators, and government grants. Explore all of your options and think outside the box when it comes to funding your startup.

6. Stay Persistent

Securing funding for your startup can be a long and challenging process, but don’t get discouraged. Stay persistent and keep pushing forward, even in the face of rejection. Remember that every successful entrepreneur has faced setbacks along the way, and that perseverance is key to securing funding for your big idea.

In conclusion, securing funding for your startup is an essential step in turning your big idea into a successful business. By doing your homework, crafting a compelling pitch, building relationships, being transparent, exploring alternative funding options, and staying persistent, you can increase your chances of securing the funding you need to bring your startup to life. So, roll up your sleeves, get out there, and make your big idea a reality!

Funding Your Startup: Navigating the World of Investors